A Look Back at Bitcoin in 2019

And a look ahead at Bitcoin's place in a portfolio over the next decade.

Welcome to the first newsletter from UTXO Management, covering insights and trends in the Bitcoin and digital assets ecosystem. I hope you enjoy it and don’t hesitate to hit reply with any feedback!

2019 in Review

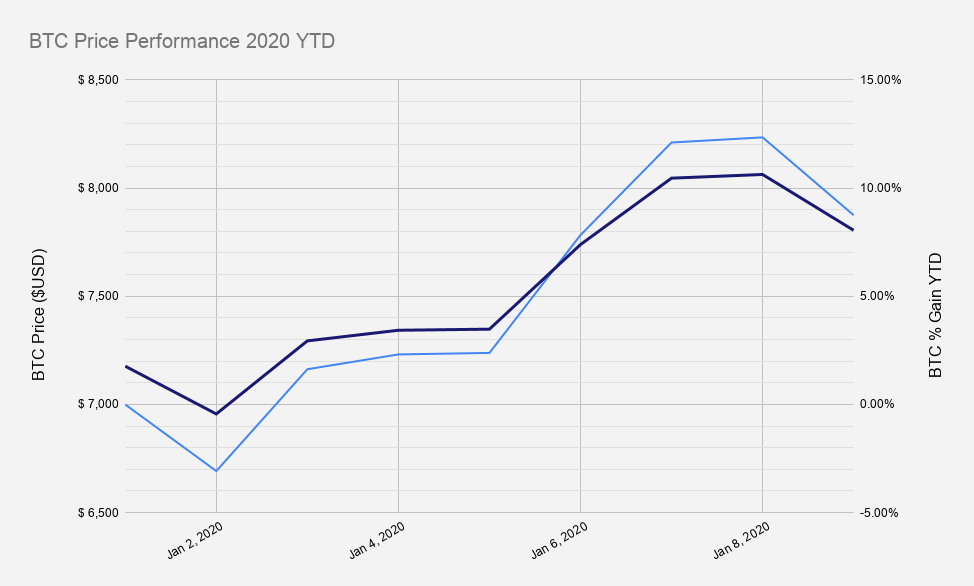

In the first weeks of 2020, we've already seen a 12% rally in Bitcoin prices. Notable narratives to watch include Bitcoin as a safe-haven asset during recent tensions with Iran and the Bitcoin mining hash rate hitting new all-time highs. Colin Harper wrote a great piece for Bitcoin Magazine about Bitcoin's fundamentals growth in 2019 and Jameson Lopp was back with another annual review of Bitcoin's raw numbers.

Bitcoin as a Portfolio Diversifier

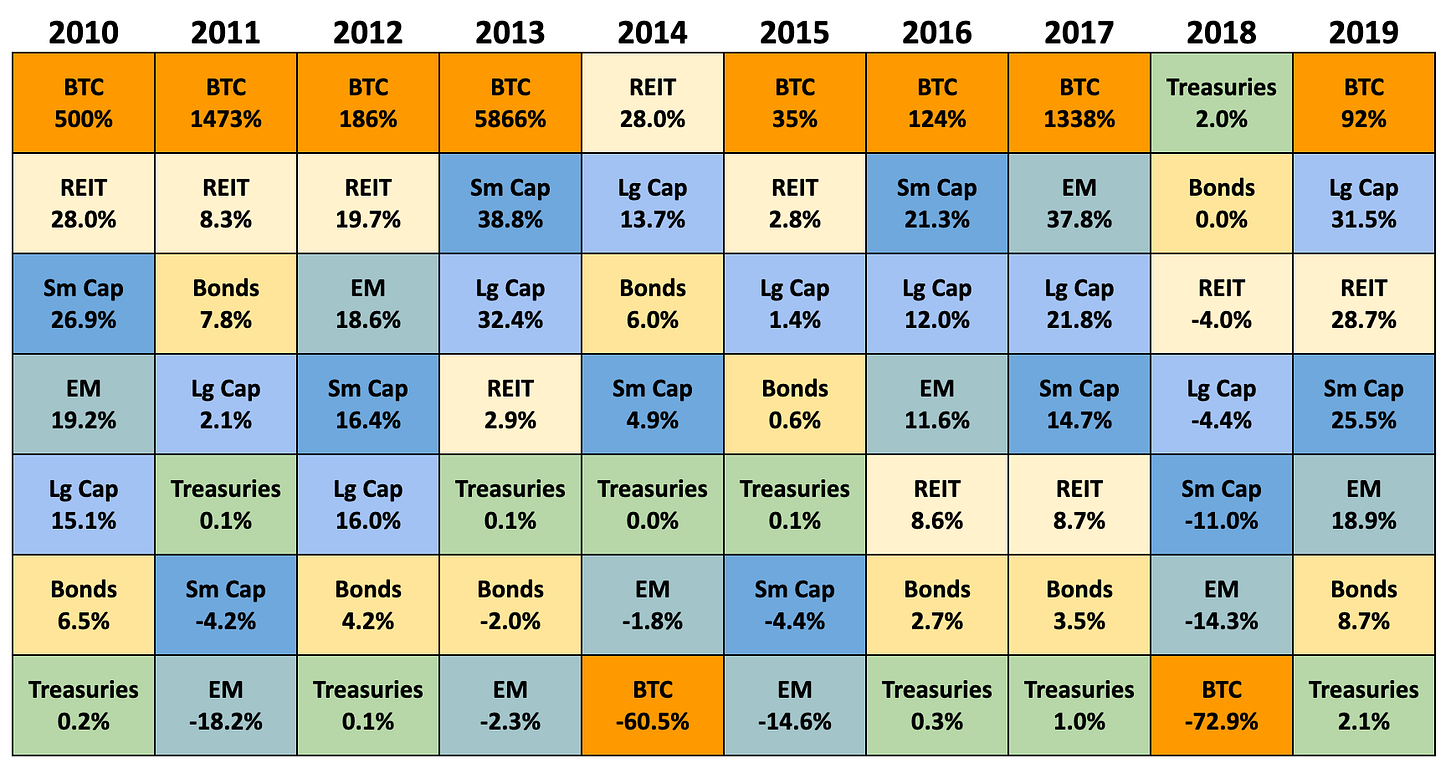

In 2019, Bitcoin was once again the best-performing asset class. It has been the best performing asset for 8 of the past 10 years, reigning as the best performing financial asset of all time according to Bloomberg with 9,000,000% returns. As Colin Harper writes for Bitcoin Magazine:

Bitcoin enjoyed a near 100 percent price gain over the course of 2019, but it otherwise had a tame year to round out the decade. 2019 was also the year that bitcoin’s price movements broke away from the rest of the cryptocurrency pack — and it continued to present itself as an uncorrelated hedge to macro financial assets.

At UTXO, we're focused on analyzing the on-chain, fundamental indicators and understanding Bitcoin's economic cycles to capture the upside of digital assets, while avoiding the 80% corrections.

Data: Off the Chain Capital, reflects Lg. Cap - S&P 500 Index; Sm. Cap - Russell 2000 Index; EM - MSCI Emerging Markets Index; REIT - FTSE NAREIT All Equity Index; Bonds - Barclay’s U.S. Aggregate Bond Index; Treasuries - 3 Month Treasury Bill Rate.

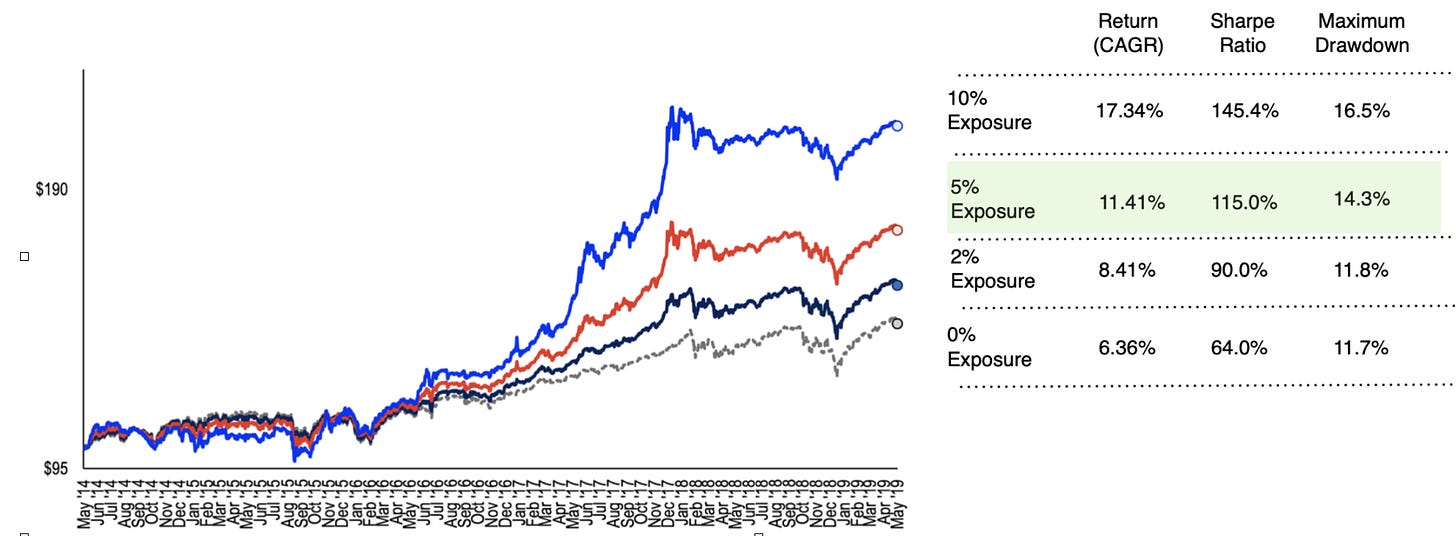

Bitcoin has a place in any portfolio as a diversifier - a non-correlated asymmetric asset with a huge upside. Adding a small amount of digital assets to your portfolio can increase risk-adjusted returns. This chart from Fundstrat shows the historical impact of adding bitcoin to a 60/40 equities and bonds portfolio from May 2014 to May 2019. Notice the increase in Sharpe Ratio.

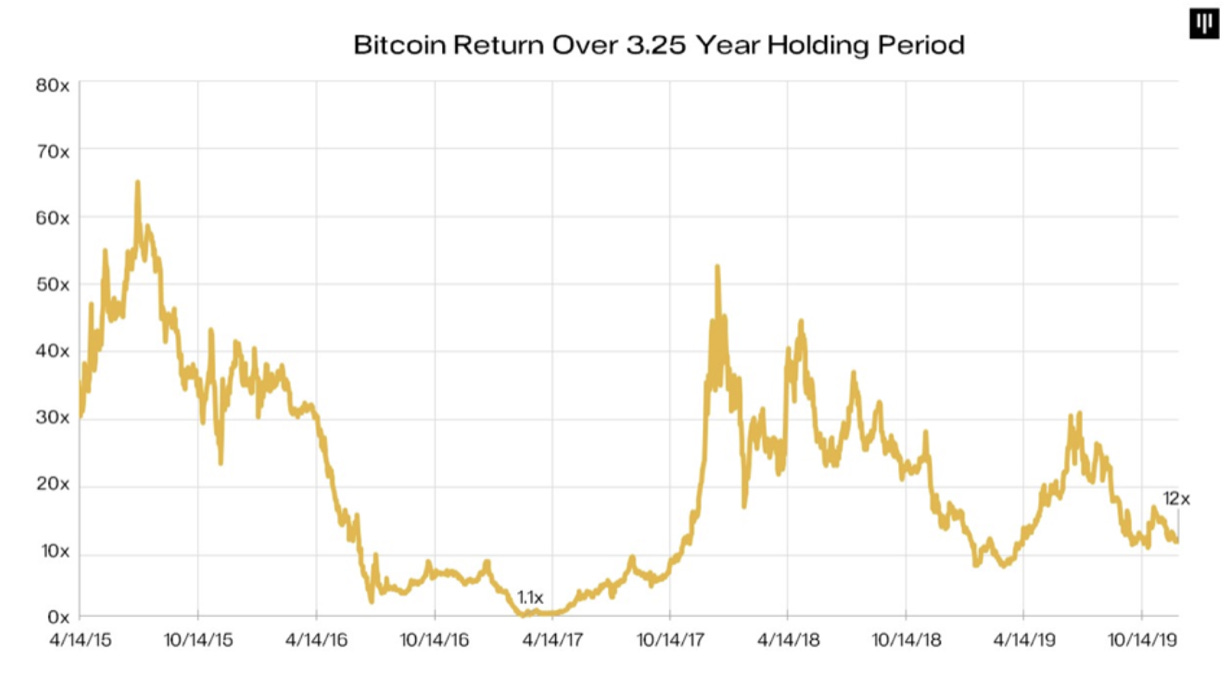

A long term outlook is critical - if you have the patience to hold BTC for a full (3.25 year) cycle, you've historically always had a positive return on your investment.

Source: Pantera Capital

About UTXO Management

UTXO Management is a value-focused digital asset manager investing in mispriced opportunities during the current Bitcoin macroeconomic cycle through its 210k Fund. UTXO was created in 2019 by David Bailey, Tyler Evans, and Coyn Mateer, three partners who’ve been investing in Bitcoin and other digital assets since 2012 and own the world’s largest Bitcoin media company and conference series.

Get in Touch

Reply to this email or reach out to coyn@utxo.management to schedule a time to meet the UTXO team.

DISCLAIMER: NOT INVESTMENT ADVICE

This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial or other advice. Nothing contained in this presentation constitutes a solicitation, recommendation, endorsement or offer by BTC Inc., UTXO Management or any third-party service provider to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.