Bitcoin Is the Best Performing Asset YTD

Counting down to the Halving

To our investors and friends,

2020 is off to a strong start for Bitcoin! The BTC price has rallied almost 30% since the first of the year and hit a high of $9,436 earlier this week. Volumes have been low, with little sell-side liquidity, likely driven by the Chinese New Year holiday season. We remain very bullish on Bitcoin through the halving, as the BTC price has historically had a strong performance in the 3 months prior.

~100 days until the Halving

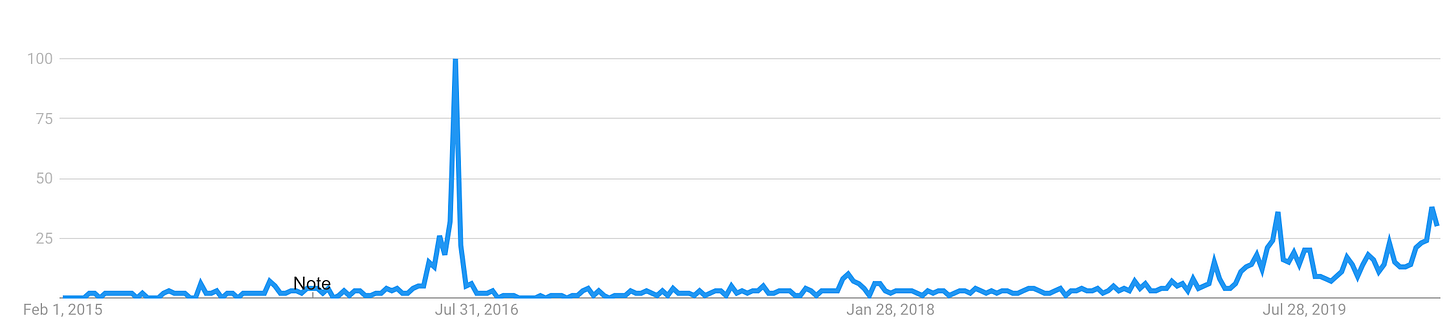

We’re on track for the halving to happen in late April or very early May and people are just beginning to notice, as shown on the chart below. Read Bitcoin Magazine on why the 2020 halving is the most important yet for Bitcoin.

Google Trends search interest in “bitcoin halving” over the past 5 years.

Bitcoin as a Diversifier

This week has highlighted the opportunity for BTC to be an uncorrelated asset in your portfolio, as the S&P 500 posted its worst day in almost four months, down 1.6% on concerns about the impact of coronavirus. However, BTC gained almost 5.8%, while gold rose as much as 1.1%. As Bloomberg writes, “Bitcoin’s claim for being digital gold appears to have another piece of evidence in its corner.”

News Highlights

GBTC Becomes SEC Reporting Company

The Grayscale Bitcoin Trust (GBTC), one of the Bitcoin derivatives that the 210k Fund has invested in, announced last week that it has become an SEC Reporting Company. This reduces the holding period for shares from 12 months to 6 months, giving investors earlier liquidity. It also allows new classes of institutions and funds to invest in GBTC. Many believe this is the next step towards an SEC-approved ETF for Bitcoin, which would be a huge catalyst that the industry has hoped for since years ago.

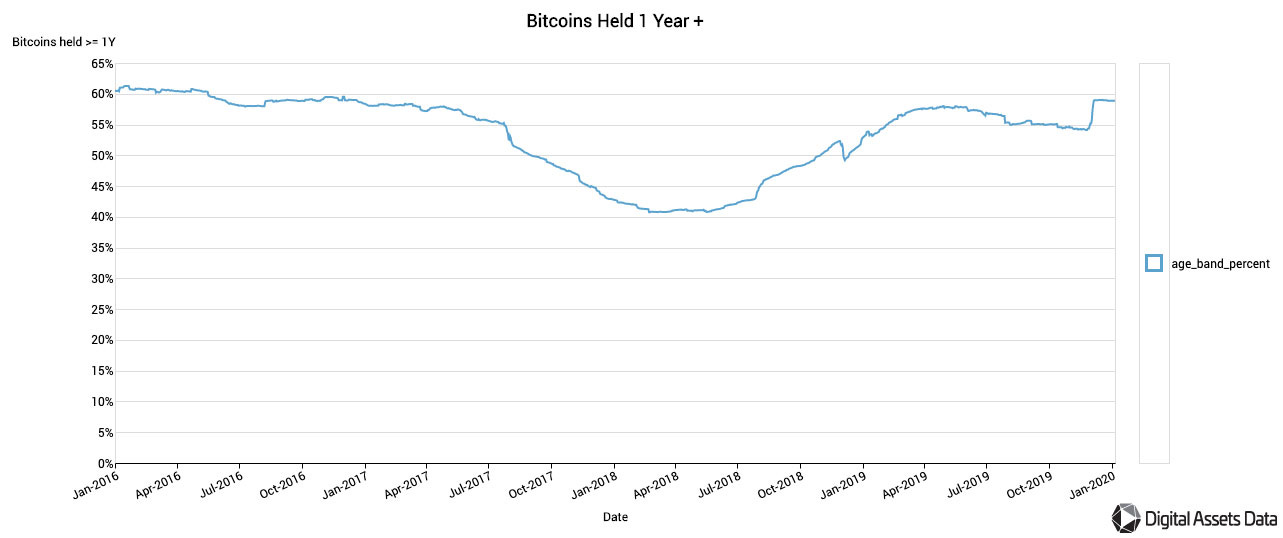

Chart of the Week: Over 10m BTC Haven’t Moved for Over a Year

Research and data company Digital Assets Data reports that over 60% of BTC, or approximately 10.7m BTC worth $96B, haven’t been transacted in over a year. This is the highest amount since 2017 and shows both the sell-side liquidity in the market drying up, as more and more BTC is concentrated in the steady hands of long-term investors who have a bullish outlook into the halving.

Ray Dalio from Davos: “Cash is Trash”

Dalio, the founder of Bridgewater Associates, has written extensively about the potential of a “paradigm shift” in the markets during the next decades and the importance of a diversified portfolio that includes assets like gold and Bitcoin to hedge against inflation and monetizing deficits.